Want to see your potential revenue?

See what businesses like yours earn with Housecall Pro in 1 - 2 minutes.

Pricing isn’t just about breaking even. It’s about making sure your business stays profitable and grows over time. One of the most effective ways to do that is by using markup to set smart, strategic prices.

This guide breaks down what markup is, how it differs from margin, and how to calculate it in a few simple steps. You’ll learn how to total your costs, choose a markup percentage, and avoid common pricing mistakes to make sure every job helps hit your goals—not just cover your costs.

Markup vs. margin

Markup and margin are closely related, but they measure different things.

- Markup is the amount you add to your cost to set your selling price. It’s calculated based on your costs.

- Margin (or profit margin) is the percentage of your selling price that you take as profit. It’s calculated based on your revenue.

For example, let’s say you have a job that costs $100 for materials and labor. You quote your customer $150 to complete it.

Your markup would be: ($150 – $100) / $100 = 50%

Your margin would be: ($150 – $100) / $150 = 33%

Many pros confuse these two, but mixing them up can hurt your pricing and profits. For most home service businesses, markup is the best way to estimate job costs and set profitable prices.

How to calculate markup step by step

Calculating markup is simple. Once you know your costs, just plug the numbers into the formula below.

(Price – Cost) / Cost x 100 = Markup Percentage

Let’s walk through the process step by step to make sure you’re using the right numbers—and not leaving profit behind.

Step 1: Total your costs

First, figure out how much it costs you to complete a job. This should include both direct and indirect costs.

Direct costs: labor, materials, subcontractors

Your direct costs are what you spend to complete the job itself. Think labor, materials, and subcontractors. Here’s how to calculate each:

- Labor: Multiply the hourly wage by the estimated hours.

Example: $30/hour × 5 hours = $150 labor cost

- Materials: Add up the cost of all parts and supplies needed.

$75 in replacement parts + $10 in consumables = $85 material cost

- Subcontractors: Include the full cost of any third-party help you hire to complete the job.

Example: If you bring in an electrician and pay them $200 for their work, that’s $200 added to your direct costs.

Add all of these together, and you’ll get your direct costs.

Indirect costs: overhead and burden

Your indirect costs are the amounts you spend to keep your business running behind the scenes. These aren’t tied to one specific job but still affect your profitability, so they should be factored into your pricing. Common indirect costs include:

- Tools and equipment

- Fuel

- Insurance

- Admin time

- Software subscriptions

- Uniforms

You can calculate indirect costs in two ways, depending on how you estimate jobs:

- Hourly overhead (best for time-based pricing):

Monthly overhead / total billable hours = hourly overhead rate

Then multiply by the estimated job hours.

- Per-job overhead (simpler but less precise):

Monthly overhead / average number of jobs per month = overhead per job

Choose the method that best fits how you quote work. The goal is to make sure you’re covering all your expenses—not just the ones that show up on the job site.

Step 2: Choose your markup goal

Next, determine how much you’d like your markup to be. This goal will depend on factors such as:

- Trade or service type: Different trades have different cost structures. For example, HVAC and plumbing usually have more overhead than cleaning or landscaping, so markup needs to account for that.

- Business experience: Newer businesses might need to be more conservative with pricing to win jobs, while established ones can build higher margins.

- Seasonality or urgency: Seasonality can affect demand. For example, roofing companies might be slower in winter, while HVAC companies might be busy in summer. Charging more during peak season can help maximize profits, while slower seasons might require more competitive rates. You can also increase markup for emergency or weekend work.

Set a realistic target that reflects your expenses and desired profit.

Industry benchmarks by trade

No two businesses are exactly the same, but markup ranges are often similar across the same trade. Common markup ranges include:

- HVAC: 50% to 80%

- Plumbing: 40% to 70%

- Electrical: 40% to 65%

- Home cleaning: 30% to 50%

- Appliance repair: 50% to 100%

- Handyman: 35% to 60%

Use these as a guide, but always tie your markup back to your real costs.

Step 3: Apply formula and determine price

Once you’ve ironed out the basics, use the formula to get your price. Let’s say that your total job cost is $400, and you want a 50% markup.

Price = $400 + ($400 x 0.50) = $600

$600 is what you would charge your customer.

Step 4: Calculate markup vs. margin

Once you’ve priced the job, check your margin. Markup helps you set your prices, but margin tells you how much of that price you’re actually keeping as profit. It’s a key metric for measuring how effective your pricing strategy is and gives you a clearer picture of whether you’re meeting your profit goals.

So, using the same $400 job with the $600 price from above:

Margin = ($600 – $400) / $600 = 33%

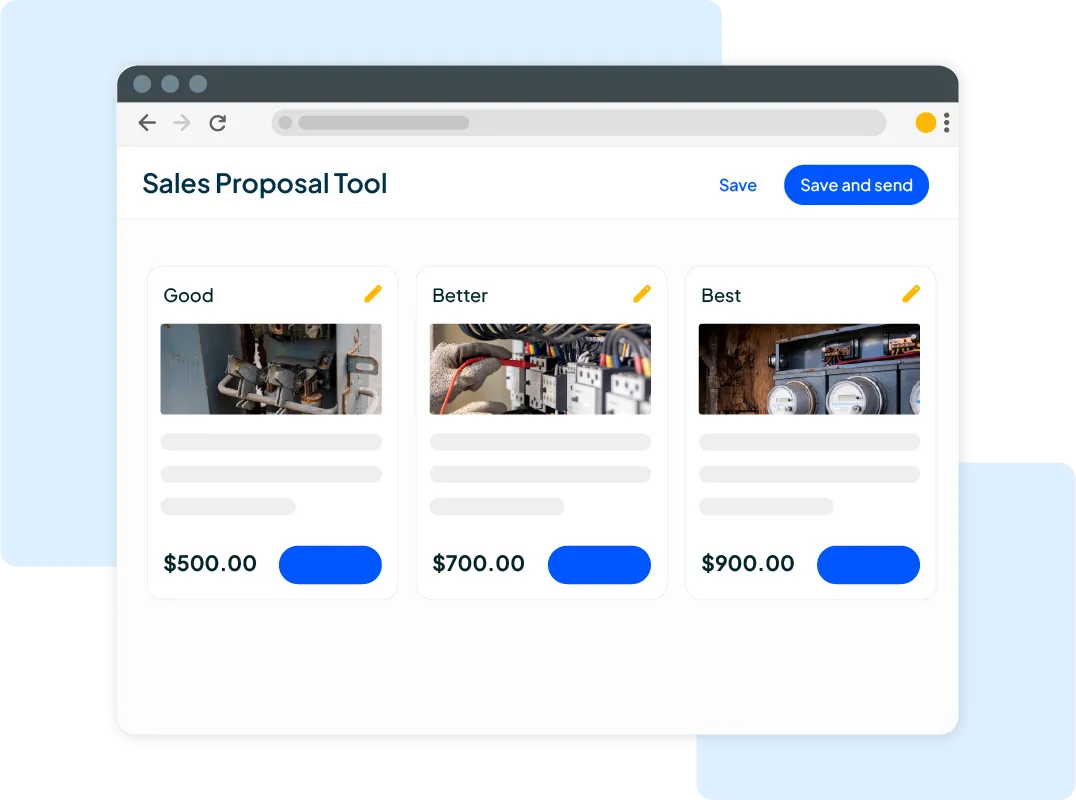

If you don’t want to run the numbers manually every time, Housecall Pro’s Job Costing feature can help. It tracks your costs, markup, and margin in real time so you can:

- Automatically track labor, materials, and overhead

- Apply consistent markup rules across services

- Build quotes that update in real time based on job-specific details

- See your estimated profit margin before sending the quote

- Avoid undercharging due to missed costs or last-minute changes

It takes the math—and the guesswork—out of pricing, so you can quote quickly and confidently.

Get In Touch: 858-842-5746

Let us earn your trust

On average, Pros increase monthly revenue generated through Housecall Pro by more than 35% after their first year.

See plan options and feature breakdown on our pricing page.

How to calculate selling price using markup percentage

If you know your total cost and your desired markup percentage, it’s easy to calculate your selling price. This formula is particularly helpful for recurring services or standardized jobs like maintenance or inspections:

Selling price = cost x (1 + markup % as a decimal)

Using this formula ensures that you cover costs and hit your target profit margin without guesswork.

Step 1: Add up your total job cost

First, calculate your job cost. Remember to include both direct and indirect costs. For example:

- Labor: $200

- Materials: $100

- Overhead allocation: $50

- Total cost: $350

Step 2: Choose your markup percentage

Pick a markup percentage that reflects your desired profit while accounting for the market, your costs, and customer expectations.

Remember, your markup percentage is calculated from your cost, not your final price. That distinction matters because overestimating your markup based on price can lead to undercharging. Use the industry benchmarks we mentioned earlier as a starting point, but always tie your percentage back to your actual expenses and profit goals.

For this example, let’s say your target is 50%.

Step 3: Use the markup formula to calculate selling price

Plug your numbers into the markup percentage formula. In this example, this looks like:

$350 x (1+ 0.50) = $525

$525 represents your selling price.

Step 4: Double-check your margin (optional)

If you’d like, you can double-check your margin. This can be helpful for comparing your prices to competitors. In this example, it looks like this:

Margin = ($525 – $350) / $525 = 33%

Use markup calculators and tools

Manual math works, but it takes time and the potential for miscalculations is high. Save yourself time and improve accuracy by using tools like our markup calculator. Simply plug in your numbers, set target margins, and get instant price recommendations.

Common mistakes and how to avoid them

Calculating markup isn’t one-size-fits-all, and even small missteps can lead to lost profit. Here’s how to steer clear of common pitfalls.

Underestimating indirect costs

It’s easy to overlook costs like fuel, admin time, and even software subscriptions. But these expenses can add up quickly and shrink your profits.

Tip: Use Housecall Pro’s Job Costing feature to automatically account for recurring indirect expenses in your quotes.

Confusing markup and margin

Markup and margin are related, but they’re not interchangeable. Mistaking one for the other can lead you to price too low and leave money on the table.

Remember that markup is calculated based on your cost, while margin is your profit expressed as a percentage of the final price. Using the wrong one (or mixing them up) can majorly impact your bottom line.

Failing to factor in job-specific variables

Not every job is the same. Some involve long travel distances, last-minute calls, or higher-risk tasks that demand extra time and precautions. If your pricing isn’t accounting for these variables, you’re unknowingly eating into your profits.

To avoid undercharging, build pricing templates that include fields for add-ons like emergency fees, travel time, and risk-based surcharges. Use Housecall Pro to add custom line items—like travel time, risk premiums, or after-hours fees—so every quote reflects the real cost of the job.

Tips to optimize your markup strategy

If you want your pricing to stay accurate and competitive, you need to revisit it regularly. Small adjustments over time can prevent big losses and help you stay on track with your profit goals.

- Review costs monthly or quarterly: Materials, fuel, and labor rates fluctuate. Check in regularly to ensure your pricing lines up with actual expenses.

- Adjust markup by season or demand: If you’re slammed in the summer but slow in the winter, adjust your markup strategy accordingly. This will help balance cash flow and maintain profitability year-round.

- Check competitor pricing in the area: Knowing what others charge helps you stay competitive. Use this data to justify your value, not slash your rates.

- Reassess pricing after hiring or buying new tools: New team members or tools can impact your overhead. Revisit your markup after these changes to ensure your pricing still covers your full costs.

Next steps

Getting your markup right means knowing every quote you send is profitable—not just competitive. When you know your pricing is accurate, your costs are covered, and your margins are healthy, you can focus on growth instead of second-guessing every estimate.

With Housecall Pro’s tools, you can build pricing systems that scale—saving time, improving accuracy, and protecting your margins on every job.

Ready to get started? Contact our customer care team for a free 14-day trial.

FAQ

-

What’s a good markup?

-

A good markup usually falls between 30% and 70%, depending on your trade, overhead, and business goals. You might use higher markups for emergency jobs, low-volume services, or when indirect costs are high. The key is to cover all of your expenses while still offering competitive, value-based pricing.

-

Can you use different markups for different services?

-

Yes, you can use different markups for different services. For example, you might apply a higher markup for one-off jobs or services with unpredictable costs and lower markup for standard, repeatable tasks. Segmenting markup by service type helps maintain profit while staying fair and competitive across your offerings.

-

How often should you reprice?

-

You should generally revisit your pricing every quarter, or whenever your costs change significantly. This includes labor increases, fuel price spikes, or software/tool upgrades. Regular reviews make sure your prices are still on par with your profit goals.

-

Should you tell customers your markup?

-

In most cases, you should not tell your customers your markup. They’re buying the total value you deliver, not your internal cost structure. Instead of disclosing your markup, focus on communicating the benefits, reliability, and results of your service.

-

Is markup taxable?

-

You’re taxed on the total price you charge, not just the markup. Tax rules vary by state and service type, so it’s a good idea to chat with a CPA or tax advisor to ensure you’re charging and reporting sales tax correct.