Want to see your potential revenue?

See what businesses like yours earn with Housecall Pro in 1 - 2 minutes.

Choosing the right legal structure for your home service business isn’t just about paperwork. It affects how you’re taxed, how protected you are, and how professional your business looks to customers. In a field where you’re working inside people’s homes and handling expensive systems, those details matter. A lot.

If you’re just starting your home service business, you’re probably deciding between two common options: sole proprietorship or LLC. Both have pros and cons. In this guide, we’ll explain how each choice works, what they cost, and when it makes sense to choose one over the other.

- What is a sole proprietorship?

- What is an LLC?

- Key differences between LLCs and sole proprietorships for home service businesses

- Examples for home service businesses

- Costs of an LLC vs. a sole proprietorship

- When to be a sole proprietor

- When to be an LLC

- Can you switch from sole proprietor to LLC later?

- How Housecall Pro helps manage your business

What is a sole proprietorship?

A sole proprietorship is the simplest way to run a business. There’s no separation between you and your company: you own the assets, keep the profits, and take on the risks.

For a solo contractor or handyman, it’s an easy way to start working fast. But that simplicity also means you’re personally on the hook for business liabilities.

Pros

- No setup costs: In most states, you can start without formal filings.

- Full control: It’s your business, and you make all the decisions.

- Simple tax filing: Report income on your personal tax return—no separate return required.

Cons

- Uncapped personal liability: If you’re sued, your personal assets are on the line.

- Tougher to build trust for large jobs: Some clients prefer businesses with formal structures.

- Limited scalability: Hiring and financing can be more of a challenge.

What is an LLC?

A limited liability company (LLC) is a separate legal entity that shields your personal assets from most business-related risks. If your company faces a lawsuit or defaults on a debt, your home, car, and savings are usually protected.

That makes LLCs a smart choice for high-value jobs or growing teams.

Pros

- Personal asset protection: Reduced risk if something goes wrong.

- Tax options: There are various ways to structure taxes, which helps keep costs lower as you grow.

- Professional image: The “LLC” designation signals credibility to clients and partners.

Cons

- Setup cost: Filing fees can run anywhere from $35 to $500, depending on your state.

- Ongoing compliance: You must meet compliance requirements, which might include annual reports and registered agent requirements.

- More paperwork: You’ll need separate bank accounts and an operating agreement.

Key differences between LLCs and sole proprietorships for home service businesses

For tradespeople, liability and compliance are big concerns. If something goes wrong on the job, the right business structure can protect your personal assets. It also plays a role in whether you can hire employees, qualify for loans, and meet client requirements for insurance or bonding.

Here’s how these structures compare in the areas that matter most:

Liability protection

With a sole proprietorship, you’re personally on the hook for all debts and lawsuits. If something goes wrong, your personal assets may be at risk. An LLC creates a legal shield around your personal assets, provided that you stay compliant. That includes keeping your business and personal finances separate, filing annual reports, maintaining insurance, paying state fees, and meeting all licensing or regulatory requirements.

Taxes

As a sole proprietor, your business income is taxed as personal income, plus self-employment tax. LLCs are taxed the same way by default (pass-through), but you can choose S corp status to potentially save on taxes by paying yourself a salary and taking the rest as distributions, which aren’t subject to self-employment tax. Just note that S corps come with more rules and administrative work.

Formation and maintenance

Sole proprietorships usually only require a DBA (Doing Business As), which means you’re registering a business name that’s different from your legal name. These are quick and affordable to set up. LLCs typically require state filings to legally establish your business as a separate entity, which come with a $35–$500 fee. You’ll also need to file annual reports or pay maintenance fees, so expect a bit more paperwork and ongoing compliance.

Hiring workers or subcontractors

You can hire employees as a sole proprietor, but you’re personally liable for payroll mistakes, tax issues, or workplace injuries. Forming an LLC reduces that risk and makes it easier to set up formal contracts, workers’ compensation coverage, and payroll systems.

Licensing and insurance needs

Both sole proprietorships and LLCs must meet trade-specific licensing and insurance requirements to operate legally. However, clients—especially commercial or government accounts—may require proof of an LLC for bidding or compliance. Having an LLC can also make it easier to qualify for higher insurance limits and bonding, which are essential for landing larger, higher-risk jobs.

Examples for home service businesses

Choosing between an LLC or sole proprietorship makes a big difference in both the risk you take on and your opportunity for growth. Consider these examples:

- Plumbing: You’re just getting started and working solo on small residential jobs. A sole proprietorship may be enough at first, but if a water heater install goes wrong and floods a basement, your personal assets could be at risk. Upgrading to an LLC offers more protection as you take on higher-value jobs.

- HVAC: You’re scaling up and hiring a helper for installs and maintenance. If they get injured on the job, an LLC helps protect your personal finances from claims that go beyond your insurance coverage.

- Electrical: A commercial property manager asks for your W-9 and proof of LLC status before offering a long-term contract. Even if you’re capable of the work, being a sole proprietor may disqualify you from bigger, higher-paying opportunities.

- Cleaning services: You’re expanding and want to bring on part-time help for recurring office clients. An LLC makes it easier to set up payroll, meet insurance requirements, and demonstrate professionalism to commercial accounts.

- Handyman: You repair a railing at a rental property. Months later, it gives out and someone is injured. As a sole proprietor, you could be personally liable for medical costs and legal fees if your insurance doesn’t fully cover the incident. An LLC creates a legal buffer.

- Lawn care: You work seasonally and keep things simple—just you, your truck, and some basic equipment. If your jobs are low-risk and you’re not planning to hire, a sole proprietorship may be an affordable way to get started. But if you plan to grow or take on commercial contracts, forming an LLC could be a smart next step.

Costs of an LLC vs. a sole proprietorship

Money matters, particularly when you’re starting a new business. Sole proprietorships are nearly free to set up, while LLCs come with filing and maintenance fees that vary by state. Here’s what you can expect and how to budget for it.

Formation fees by state

Starting as a sole proprietor costs little more than your time. In most cases, you only need to file a DBA if you want to operate under a business name that’s different from your legal name. If you’re using your own name (e.g., “John Smith Handyman Services”), no registration is usually required. Filing a DBA usually costs $10 to $100, depending on your state.

Forming an LLC is more of an investment. Fees vary widely by state, ranging anywhere from $35 to $500 to file, plus annual fees or reports to stay in good standing. Check your state’s website for specific LLC fees.

| Cost Element | Range (All States) | Examples |

|---|---|---|

| Formation Fee | $35 to $500 | Lowest: Montana ($35 for for-profit corporations) Highest: Massachusetts ($500) |

| Annual/Biennial Fee | $0 to $800 | Lowest: Arizona (Free) Highest: California ($800) |

Ongoing annual report fees, registered agent costs, etc.

As a sole proprietor, you typically won’t have to worry about annual state fees. Just keep your business licenses and taxes up to date, and you’re good to go.

LLCs need a little more attention. For example, in Florida, you must file an Annual Report every year with the Florida Division of Corporations. This filing costs $138.75, and if you miss that deadline, there’s a $400 late fee.

You’ll also need a registered agent who’s designated to receive legal and government notices on your behalf. You can serve as your own for free, but most pros hire a service, which costs roughly $100 to $300 per year.

Tools vs. legal services

Because starting as a sole proprietor is so simple, most home service pros handle setup themselves. Forming an LLC is a little more involved, but you can still do it on your own. Often, you’ll just need to pay your state’s filing fee.

If you’d rather skip the paperwork, you can use an online filing service or hire an attorney. This typically adds $100 to $400 (or more for legal help), but many pros find it’s worth the cost to avoid mistakes that could delay jobs or cause compliance issues.

Cost example

Let’s say you live in Texas and are starting a home cleaning business. Here’s what that would look like for each of these business structures:

- Sole proprietorship: $0 to start, plus a $25 filing fee for a DBA if you need one

- LLC: $300 state filing fee, $25 fee for DBA, plus $0–$300 per year for a registered agent

When to be a sole proprietor

Starting as a sole proprietor can make sense in the early stages of your business. It’s fast, easy, and cheap, with minimal paperwork and no formal filings or annual fees. Here are a few situations where sticking with this business model works:

- You’re starting solo and testing the market: If you’re unsure about demand, it makes sense to start small. This limits your investment and allows you to get up and running quickly.

- You want low upfront costs and minimal paperwork: This is the easiest, most affordable way to start a business. You won’t have to deal with state filings beyond a DBA in most cases.

- You’re not ready to set up a separate business bank account: We recommend separating your personal and business finances regardless of the structure you choose, but you don’t legally have to do so as a sole proprietor.

- You plan to convert later when the business grows: Many successful pros start as sole proprietors and switch to LLCs once they hire or scale.

When to be an LLC

An LLC isn’t always the starting point, but certain situations make the added cost and paperwork worth it, especially when risk, reputation, and revenue are on the line. Here are a few situations when forming an LLC makes the most sense:

- You’re taking on high-liability jobs (think gas lines, water damage, electricity): Risky jobs mean bigger stakes. If a mistake causes property damage or injury, an LLC helps shield your personal assets from lawsuits that exceed insurance coverage.

- You want to grow, hire, or market more professionally: Expanding your team means more liability and paperwork. An LLC simplifies hiring and signals stability to customers (a must for landing big jobs).

- You’re investing in tools, trucks, or advertising: The more you spend on your business, the more you stand to lose. An LLC protects personal assets and can improve your financing options.

- You need more protection for personal assets: An LLC creates a legal firewall between your business and personal life. If your business gets sued or faces debt, your home and savings generally stay off-limits.

Can you switch from sole proprietor to LLC later?

Yes. Many home service pros start as sole proprietors then switch to LLCs when revenue, liability, or hiring needs increase. The process is fairly straightforward. We’ll go over the details below.

Keeping your business name during the transition

If you operate under a DBA, you can often keep it by linking it to your new LLC. You’ll need to file Articles of Organization with your state and apply for a new Employment Identification Number (EIN) if your legal structure changes or you plan to hire employees.

Don’t forget to open a separate business bank account and update invoices so payments keep flowing.

Managing tax and payroll changes

Switching to an LLC usually means getting a new EIN, updating your tax records, and separating business banking. You may also need to adjust payroll or accounting systems if you elect S corp status, so check with your accountant to avoid surprises.

How Housecall Pro helps manage your business

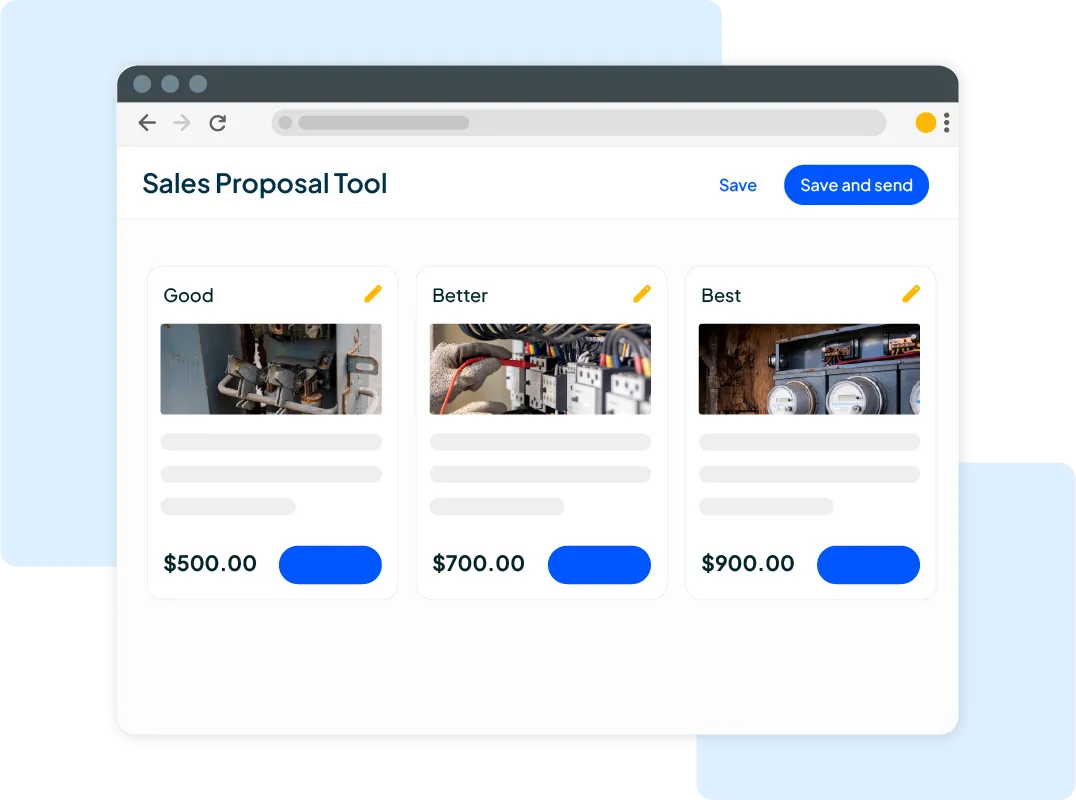

Whether you’re running a sole proprietorship or an LLC, managing your business can be a big task. Housecall Pro gives you the tools you need to stay organized and look professional at any stage.

- Scheduling, dispatch, and customer management: Easily schedule jobs, automate reminders, and keep customers updated in real time.

- Invoicing, payments, accounting integrations: Create invoices in seconds, accept credit cards on-site, and sync your transactions thanks to seamless accounting integrations with QuickBooks or Xero for easier tax prep (the IRS recommends digital recordkeeping).

- Insurance, license tracking, and record-keeping: Store and manage all your licenses, permits, and insurance documents in one secure location so you’re always prepared for compliance checks.

- Tools to scale from solo to multi-tech operation: As your business expands, add new users, enable advanced features, and use built-in marketing tools. This makes it easy to scale from a one-person shop to a multi-tech operation without disrupting your workflow.

Get In Touch: 858-842-5746

Let us earn your trust

On average, Pros increase monthly revenue generated through Housecall Pro by more than 35% after their first year.

See plan options and feature breakdown on our pricing page.

FAQ

-

Do you need an LLC to get bonded or insured?

-

No, you do not need an LLC to get bonded or insured. Sole proprietors can qualify, but some insurers prefer LLCs because they indicate a formal structure and limited liability protection.

-

When to switch from sole proprietorship to LLC?

-

Switch from a sole proprietorship to an LLC when your risk or revenue increases, or when you start hiring employees. These scenarios expose you to liability, and LLC status helps protect your personal assets.

-

At what income level is an LLC worth it?

-

When your income level exceeds $50,000 in profits per year or you take on high-liability jobs, it often makes sense to switch to an LLC. At this point, the protection and potential tax savings typically outweigh the added cost of filing for and maintaining an LLC.

-

What’s the biggest disadvantage of an LLC?

-

The biggest disadvantage of an LLC is the cost and compliance. Filing fees, annual reports, and record-keeping requirements make LLCs more expensive and time-consuming than sole proprietorships.

-

Should you pay yourself a salary from an LLC?

-

If your LLC elects S corporation tax status, then yes, you must pay yourself a reasonable salary. If you’re taxed as a sole proprietorship (as is the case with most single-member LLCs), you take the owner’s draws instead of a formal paycheck.